Although Cash Cards issued by Cash App are now supported by many banks, it is not easy to find an ATM that supports Cash App cards, especially if you live in the outskirts or in the suburbs. But I’ve already found a Cash App ATM near me. Do you want to know how?

There are at least 100 different banks and financial institutions in the United States alone that now accept Cash Card. However, only nine such banks and companies allow direct cash deposits. But you can easily find one by using the “locator” feature in the app.

Besides, you can get a full list of available ATMs in your locality by visiting the official site of the Cash App. But, before we reveal our complete list, let’s first understand how you can transact using your Cash App card this year.

Need Easy & Extra $300/Mo For Free?

Free Cash: Get paid for taking surveys & testing apps.

Ysense: Earn up to $100 on completing your first month surevies.

Paid surveys by Survimo: Paid over 35 Million. Earn up to $25 per survey

How To Withdraw Money From Your Cash App Card?

Although every Cash Card issued by the cash app has a money withdrawal facility, not every person knows how to use the Cash App at an ATM.

However, Cash Card is a VISA-approved card that you can use like any traditional debit card. You follow the steps mentioned below to get cash from any ATM in the United States.

- Step 1: Insert your Cash Card into the ATM machine and put your PIN number when prompted.

- Step 2: Now, tap on the “Debit” option (some ATMs may not have these options).

- Step 3: Tap on the “Withdrawal” option and enter the amount when prompted.

- Step 4: Tap on the “OK” button and accept the confirmation message on your Cash App account.

- Step 5: Receive the amount in cash and then remove your card from the ATM.

There is no doubt that Cash App is genuinely among the highest paying apps like 3 Game Apps That Pay Instantly To Cash App (2024 List) that you can try this year with complete confidence.

However, you can also transfer money to your Cash Card right from your bank account to use the Cash Card as a traditional debit card.

Recommended:Unique & Cool Cash App Card Designs For Everyone [2024]

Cash App ATM Withdrawal Limits

Before you know about the Cash App ATM near me, you need to know about the withdrawal limits of your Cash Card, as it doesn’t support unlimited withdrawal even for premium members.

You can’t withdraw more than $350 at a single time from your Cash App card. You can only withdraw up to $1k in a day and up to $1k every week.

So, technically, you can only withdraw the highest amount ($350) around thrice a week. However, for each of these transactions through ATMs, you need to pay a charge between $2 and $2.5/transaction.

Cash App mainly puts this withdrawal limit to reduce the chance of card misuse. Besides, it also adds a layer of security to keep your money safe. But the best part is that you can now use your VISA Cash Card in almost any ATM in the USA.

Don’t Miss – 6 High-Paying Jobs That Pay $40 an Hour [2024 List]

Cash App ATM Charges

You need to first understand that every transaction you make on any Cash App ATM in your locality will attract transaction fees.

And this fee can range from $2 to $2.5/transaction, although a few banks also charge up to $3/transaction. However, there is a catch to avoiding this transaction fee.

If you make or deposit at least $300 in your Cash App account, this company will reimburse 3 ATM transaction fees every 31-day cycle.

Besides, it will also reimburse up to a $7 fee per transaction through your Cash App card. And below is the list of banks that are now accepting Cash App cards.

| No. | Bank Name | ATM Fee/Transaction (Non-Network) |

| 1. | Union Bank | $2.00 |

| 2. | First Horizon Bank | $2.00 |

| 3. | Frost Bank | $2.00 |

| 4. | Bank of America | $2.50 |

| 5. | HSBC Bank USA | $2.50 |

| 6. | Wells Fargo | $2.50 |

| 7. | JPMorgan Chase | $2.50 |

| 8. | Citibank | $2.50 |

| 9. | HSBC Bank | $2.50 |

| 10. | Citizens Bank | $3.00 |

| 11. | M&T Bank | $3.00 |

Although all the 11 banks we have mentioned above will accept your VISA card from Cash App, Union Bank, Frost Bank, and the First Horizon Bank offer the lowest per-transaction fee.

How To Avail Of The Direct Deposit Facility In Cash App?

You must have already understood the limits related to Cash App ATM withdrawal. But there are some specific terms that also apply even on the deposit.

You can now use your Cash App account to receive your paycheck on a monthly basis. Besides, you can also withdraw your unemployment insurance deposits through your Cash App card.

But, before you can receive direct money and even paychecks on your Cash App account, you need to activate the direct deposit facility first. And the steps are as follows.

- Step 1: Open the “Cash App” on your smartphone and log into your account using the proper credentials.

- Step 2: Once your account opens, tap on the “Banking/Money” tab at the bottom of the app.

- Step 3: Tap on the routing or account number option beside your available balance.

- Step 4: Now, type the account number and the routing number in the designated field.

- Step 5: Save the settings and exit from the Cash App.

Once you successfully set up your deposit account by using your bank account and routing number, you also need to activate the direct deposit facility from a particular account or company. And the steps to enable that are as follows.

- Step 1: Open the “Cash App” on your mobile phone and log into your account using your login credentials.

- Step 2: Tap on the “Banking/Money” tab located at the bottom of the app.

- Step 3: Once you get a new menu, tap on the “Direct Deposit” option from the list.

- Step 4: From the new menu, tap on the “Get Direct Deposit Form” option.

- Step 5: Now, type all the information of your employer or client, such as name, account number, and account type, on the designated fields.

- Step 6: Tap on the “Email Form” option and put your employer or client’s email ID.

- Step 7: Finally, tap on the “Send” button to complete the procedure.

Note: You can now check all the deposit forms in one place in your Cash App account. You need to start by tapping on the “Banking/Money” tab, followed by the “Get Direct Deposit Form” option. And then, you need to tap on the “View Previous Form” option to get the complete list.

Recommended:Make Money on Amazon: 5 Ways To Make Up To $5000 Per Month in 2024

Cash App ATM With Cash Deposit Facility Near Me

You can find many ATMs that accept Cash App cards in your locality, especially if you live in the United States or the United Kingdom.

However, not every ATM, bank, or financial institute accepts money deposits through Cash Card. And this year, there are just 11 platforms that accept direct deposits in Cash Card.

- Walmart

- Walgreens

- GoMart

- Dollar General

- 7-Eleven

- StopNGo

- Family Dollar

- Speedway

- Sheetz

- KwikTrip

- H-E-B

If you don’t have any of the outlets we have mentioned above in your locality, you can also find one from the Cash App.

And the steps to locate a nearby ATM that accepts direct deposit facility to your Cash Card are as follows.

- Step 1: Launch the “Cash App” on your smartphone and log into your account using your credentials.

- Step 2: Once your account opens, tap on the “Banking” tab located at the bottom of the app.

- Step 3: Now, tap on the “Paper Money” option from the list.

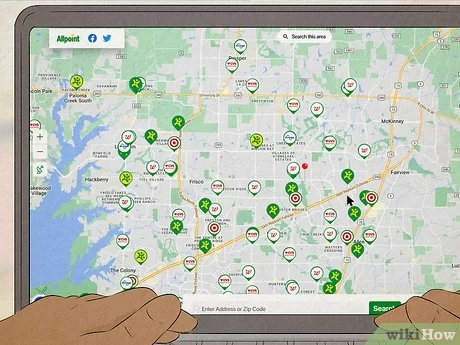

- Step 4: Type the locality or address in the designated field and hit the “Go” button (You can also use the GPS option to let Cash App automatically track your location)

- Step 5: You can now check all the available ATM options with a direct cash deposit facility in your locality.

Besides cash deposit and withdrawal facility, Cash App also gives you ample options to indulge in a side hustle, as it is among the best platforms where you can make money fast and easily this year.

Recommended: 5 Realistic Ways To Make $10k a Month in 2024

How To Find The Closest Cash App ATM Near Me?

Even I was truly confused when I first searched for a Cash App ATM near me, as I didn’t know the right way to find one.

You can now easily find your closest ATM that accepts Cash Card from your Cash App. And the steps are as follows.

- Step 1: Launch the “Cash App” on your smartphone and log into your account using your account credentials.

- Step 2: Once your homepage is opened, tap on the “ATM” option, and allow the app to track your current location.

- Step 3: Now, tap on the “Get Location” button and wait till the app search for the nearest ATM.

- Step 4: Choose any nearby ATM from the result page to deposit or withdraw money through your Cash Card.

Cash App is not limited to the money transfer facility, as you can now even watch adds for money on this fantastic app. Besides, there are several other ways to make money as well using this app.

Read: I Need Money Now: 52 Legal Ways To Get FREE Money

20+ Cash App ATMs Near Me

When I first searched for a Cash App ATM near me, I got to know that there are many major banks that now support Cash Card in the United States.

So, I’ve fetched hundred such banks, cooperatives, and financial institutes that now accept Cash Card for both money deposits and withdrawals.

- Ally Financial

- American Express

- Ameriprise

- Ameris Bancorp

- Arvest Bank

- Associated Banc-Corp

- Atlantic Union Bank

- Bank of America

- Bank of Hawaii

- BankUnited

- Barclays

- BCI Financial Group, Inc.

- BMO Harris Bank

- BNP Paribas / Bank of the West

- BOK Financial Corporation

- Cadence Bank

- Capital One

- Cathay Bank

- Charles Schwab Corporation

- CIBC Bank USA

- CIT Group

- Citigroup

- Citizens Financial Group

- City National Bank

- Comerica

- Commerce Bancshares

- Credit Suisse

- Cullen/Frost Bankers, Inc.

- Customers Bancorp, Inc.

- Deutsche Bank

- Discover Financial

- East West Bank

- EB Acquisition Company II LLC

- EB Acquisition Company LLC

- Fifth Third Bank

- First Bancorp

- First Citizens BancShares

- First Hawaiian Bank

- First Horizon National Corporation

- First Midwest Bank

- First National of Nebraska

- FirstBank Holding Co

- Flagstar Bank

- FNB Corporation

- Fulton Financial Corporation

- Glacier Bancorp, Inc

- Goldman Sachs

- Hancock Whitney

- HSBC Bank USA

- Huntington Bancshares

- Investors Bank

- John Deere Capital Corporation

- JPMorgan Chase

- KeyCorp

- M&T Bank

- Macy’s

- MidFirst Bank

- Mizuho Financial Group

- Morgan Stanley

- MUFG Union Bank

- New York Community Bank

- Northern Trust

- Old National Bank

- Pacific Premier Bancorp Inc.

- PacWest Bancorp

- People’s United Financial

- Pinnacle Financial Partners

- PNC Financial Services

- Popular, Inc.

- Prosperity Bancshares

- Raymond James Financial

- RBC Bank

- Regions Financial Corporation

- Santander Bank

- Simmons Bank

- SMBC Americas Holdings Inc.

- South State Bank

- State Farm

- State Street Corporation

- Sterling Bancorp

- Stifel

- SVB Financial Group

- Synchrony Financial

- Synovus

- TD Bank, N.A.

- Texas Capital Bank

- The Bank of New York Mellon

- TIAA

- Truist Financial

- S. Bancorp

- UBS

- UMB Financial Corporation

- Umpqua Holdings Corporation

- United Bank (West Virginia)

- USAA

- Valley National Bank

- Washington Federal

- Webster Bank

- Wells Fargo

- Western Alliance Bank

Note: If you don’t have any branches of the banks and financial institutes we have mentioned above in your locality, you can use the ATM locator option on the Cash App to track the nearest ATM that supports Cash Card.

You can expect to make around $45/hour on average, although experienced developers earn up to $100/hour. And the national average now lies around $119k/year.